Native Grape Odyssey is 1 project, 3 countries, and… lots of numbers

December 30, 2019

Every end is a new beginning – the Native Grapes Academy project in 2020

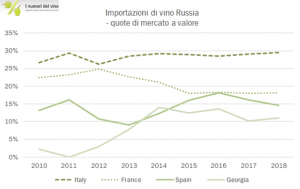

February 3, 2020The green line of success shows the return of PDO quality Italian wines. These could be what unites Russia and the Bel Paese. The green line we are referring to is that of the market, an indication of the positive trend being seen with respect to imports of European wine, particularly Italian wine to Russia.

According to statistics reported by “I numeri del vino“, Italy was among the first importers of wine into the Russian market, and despite the economic (and political) turbulence of recent years, this market has proven to be highly receptive to our quality products, specifically, wine sector products.

In 10 years, Russian imports increased by + 343%, peaking in 2017, a record year (Source: Nomisma Wine Monitor), but even 2018 was impressive, the previous year saw exports rise by +6.5%, which is why Italy is the sixth largest trading partner with the Russian Federation for both exports and imports, taking second place in Europe (behind Germany).

In the graph one can also find two other European countries that we think of instantly when talking about quality wine products; Spain and France. These two nations are competitors with Italy, but only to a point. These two countries are in fact, together with Italy, among the largest producers of quality wine in Europe; moreover, they also play an equally important role as partner countries in the Native Grape Odyssey project. Italy’s value comes close to 30% (20% in volume, by which the Spanish are slightly ahead) in a market of 900 million euros and 4.1 million hectoliters of imports.

The Made in Italy slogan once again earns its fame as a leader, they represent 7% of alcohol consumption in the country. We need them as much as they may need our wines, you know. But what are the varieties most appreciated on tables in Russia? according to popular stereotypes, tables have been packed almost exclusively with different types of vodka, but is this the reality?

Green line, red wines (and denominations).

If Russia were a colour, which colour would it be? Red, of course! That was the expected answer, but this time without any political or historical connotations. This colour is also found in wine, in many different shades, it has been increasing in popularity lately, as well as in exports of bottled wines. Unlike rosé, which Russians still find slightly less appealing to the palet, red wine accounts for 52 % of total exports, and the demand for this type of wine seems to be growing steadily. What has been most satisfying, however, is the fact that 8 of our favourite grape varieties were used to create the statistics for the green line markey graph, they have been listed in order below:

1. Sangiovese

2. Montepulciano

3. Barbera

4. Nero d’Avola

5. Primitivo

6. Valpolicella Blend

7. Dolcetto

8. Nebbiolo

The director of the ICE (Italian Trade Agency) in Moscow, Pier Paolo Celeste, said that “the Russian wine lover always prefers novelty”, however, apparently they also appreciate age, since Nebbiolo is a grape that has been used in wine for more than 400 years; creditable voices confirm this. Veronika Denisova, IWA, wine educator, wine journalist and deputy director of the Enotria Wine School in Moscow, during an interview given for the Italian Wine Podcast said “my favourite Italian wine region is undoubtedly Piedmont, because I can find Nebbiolo there, it is to be appreciated for its elegance, history, and ability to age“.

From Sangiovese to Nebbiolo, we are in fact talking about native grape varieties, native in most cases to the Tuscan and Piedmont regions, from which some of the best known and appreciated quality wines with a controlled designation of origin (DOC) are obtained, and in some cases, a guaranteed designation. (DOCG). What does this data tell us? That the search for quality and curiosity for “new” foreign products does not stop, even in a country where, in recent years, it has faced a drastic decrease in the purchasing power of its currency.

Green line, yellow bubbles.

But while it is true that 50 % of Russian consumers prefer red wine, some of attention should also be paid to sparkling wines, which have always been the mainstay of Italian and French imports, and when Russia is concerned, even Spanish ones.

We are also including the white wine market within all these rising numbers, which covers more than 25% of total consumption. In particular, the average consumer has always, gone mad for sparkling wines: from classic names like Prosecco or Franciacorta; the Italian sparkling wine market grew by +22% only in 2018, going from a market of 85 million to 97 million euros, offsetting the slight drop in still wines. All this, regardless of the problems caused by the continuing embargo of some food products branded Made in Italy. Unfortunately, in the case of sparkling wines, the focus on DOC/DOCG designations of origin remains a very neglected concept.

The news of sparkling Spanish Cava has been growing in popularity, providing an advantageous offer on the market (drinks-today.com/russian-tastes-are-changing). This rise is in Cava is partly caused by an internal difficulty to satisfy the enormous demand for bottles, per capita (about 10 litres of wine each) and partly by a real zest for life, and in this case, it is drinking Italian style.

This is a love that goes far beyond wine, and that we can find it in both catering (among the best 10 foreign restaurants in Moscow, 8 are Italian) as well as in the details that frame everyday life in the Russian capital, just go to the Russian metro stop “Rimskaya” – meaning “Roman” in Russian…found right on the green line.

In this article you only discovered 8 of the oldest red berry varieties from Italy. If you’re curious to know more, the first in-depth will be found in the next article!